About

Enterprise Investors is the oldest and one of the largest private equity firms in Central and Eastern Europe. We specialize in mid-market succession-driven buyout transactions and provision of expansion financing to high-growth enterprises across a range of sectors. Active since 1990, we have raised ten funds. These funds have invested and committed EUR 2.4 billion in 161 companies and have exited 140 of them.

Who we are

We pursue a diversified approach to the industries we invest in. Since 2023 we have been investing the capital of Enterprise Investors Fund IX. This fund, like its predecessors, finances mid-market buyouts and growth companies in sectors such as consumer products and retail, financial services and healthcare that are driven by the convergence of CEE’s domestic consumption with Western Europe. EIF IX also invests in sectors boosted by CEE’s growing internationalization and competitive cost position, including IT, industrial products and business process outsourcing. Poland accounts for approximately three-quarters of all our investments; the rest is deployed across the growing economies of the CEE EU member states.

Enterprise Investors has exited 140 companies. This number includes 35 IPOs of portfolio companies completed on the stock exchanges in Warsaw (WSE), Prague (PSE), Vilnius (Nasdaq) and New York (NYSE).

We specialize in proprietary deal sourcing. Our team of over 30 investment professionals – the most experienced in the region – has a unique combination of skills and expertise bolstered by a track record of consistent performance. The firm operates through six offices located in Warsaw, Bratislava, Bucharest, Prague, Zagreb and New York.

-

10 funds

raised

-

EUR 2.4 billion

invested and committed in 161 companies

-

140 exits

completed

-

35 IPOs

of portfolio companies

How we operate

At Enterprise Investors we combine industry expertise with local market experience. Our emphasis is on creating sustainable value that will withstand the test of time. We are prudent in our investment strategies and use leverage conservatively. We invest between EUR 20 million and EUR 75 million in established companies. Our stake ranges from a large minority position to full ownership and we take a long-term perspective, our involvement typically lasting between five and eight years.

We commit our full range of resources to the success of each portfolio company. Partnering with management teams, we help companies work out strategy, conceptualize and implement optimal financing structures and recruit top executive talent. Our investment team builds direct relationships with portfolio companies and provides hands-on support via supervisory board positions. We achieve lasting change, preparing companies for success even beyond our investment horizon.

ESG

Through our investments we have created thousands of jobs, and our portfolio companies service millions of customers across a broad spectrum of industries. Therefore, our activities have a considerable impact. With this in mind, we never invest in enterprises engaged in activities that are detrimental to the local and global society, environment or economy. At EI we systematically develop in-house environmental, social and governance (ESG) guidelines, embedding them in all our activities. Working with our portfolio companies we strive to improve their compliance and business ethics standards, reduce their environmental footprint and develop beneficial relationships with those they interact with or affect.

Our positive impact extends far beyond our investment portfolio, as we advocate sustainable business practices within the private equity industry and the broader business community. In 2015 EI became the first private equity signatory to the United Nations Global Compact in CEE. We are also actively committed to communicating ESG goals, practices and tools among the members of the Polish Private Equity Association.

Refining our approach

As a private equity fund manager it is our priority to increase the value of our portfolio companies. We invest in the fastest-changing industries such as consumer products and services, IT, financial services, telecoms and healthcare. In the process, we continually refine our investment approach in line with developments in Central and Eastern Europe.

Refining our approach

As a private equity fund manager it is our priority to increase the value of our portfolio companies. We invest in the fastest-changing industries such as consumer products and services, IT, financial services, telecoms and healthcare. In the process, we continually refine our investment approach in line with developments in Central and Eastern Europe.

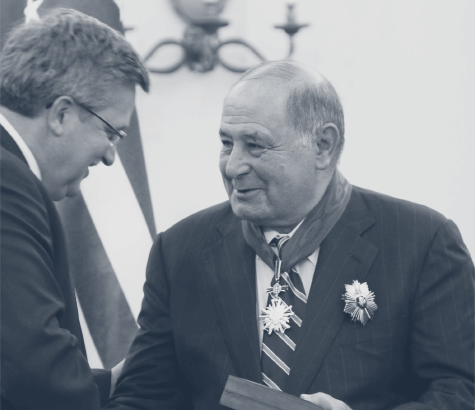

From left: President of Poland B. Komorowski presenting R.G. Faris with the Commander’s Cross with Star of the Order of Merit

From left: President of Poland B. Komorowski presenting R.G. Faris with the Commander’s Cross with Star of the Order of Merit

We support initiatives that shape the highest business standards of the region’s economies, not least as co-founders and active members of key private equity industry organizations in Poland, the Czech Republic, Romania, Slovakia and countries of southeastern Europe. Our success in combining investment efficiency with a positive impact on local communities has earned us widespread trust and respect.

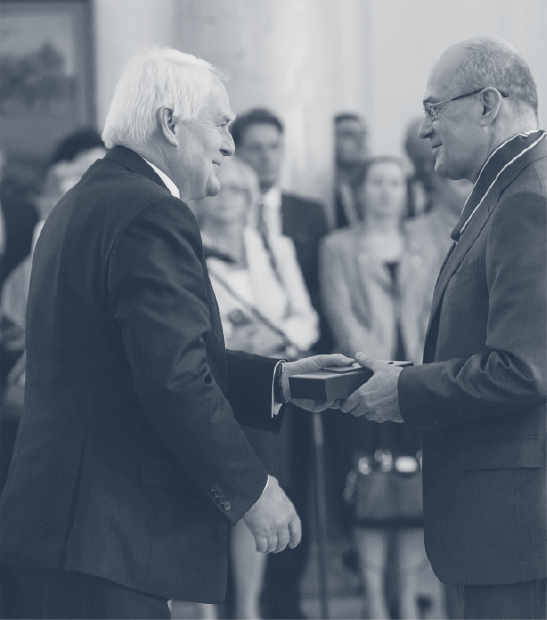

Enterprise Investors’ contribution to Poland’s political and economic transformation has been recognized by the foremost public figures of the last three decades. We are honored that our past and present leaders have been decorated with the highest state awards by Polish presidents Lech Wałęsa, Aleksander Kwaśniewski and Bronisław Komorowski. Crucially, we remain motivated by the strong belief we have in our continued future success.

From left: Z. Brzeziński, former special security advisor to the US president; L. Wałęsa, former president of Poland; J.P. Birkelund, EI founder; L. Balcerowicz, former deputy prime minister of Poland; R.G. Faris, EI founder

From left: Z. Brzeziński, former special security advisor to the US president; L. Wałęsa, former president of Poland; J.P. Birkelund, EI founder; L. Balcerowicz, former deputy prime minister of Poland; R.G. Faris, EI founder

Having established five banks, including Poland’s first mortgage bank, Enterprise Investors laid the foundations of the Polish financial services market. Our firm has also supported the development of Poland’s capital markets, floating more companies on the Warsaw Stock Exchange than any other PE investor active in the region. Many of EI’s portfolio companies – such as AVG Technologies, Danwood, intive, Kruk, LPP and PBKM to name a few – have grown into regional and international leaders.

J. Siwicki receiving the Commander’s Cross of the Order of Polonia Restituta

J. Siwicki receiving the Commander’s Cross of the Order of Polonia Restituta

History

1990

Foundation of Polish-American Enterprise Fund

1991

Polish-American Enterprise Fund’s first investment in Poland

1992

EI raises Polish Private Equity Funds I & II with total capital of USD 151 million

1994

First IPO of a company from EI’s portfolio on the WSE

PPABank1997

EI raises Polish Enterprise Fund with USD 164 million in capital

1999

EI’s first investment outside Poland

Orange Romania2000

EI raises Polish Enterprise Fund IV with USD 217 million in capital

2001

First investment in Slovakia

Orange Slovakia2004

First investment in Bulgaria

Bulgarian Telecommunications Company2004

EI raises Polish Enterprise Fund V with capital of EUR 300 million

2004

EI opens an office in Bucharest

2005

First investment in the Czech Republic

AVG Technologies2006

EI raises Polish Enterprise Fund VI with capital of

EUR 658 million

2007

EI opens an office in Bratislava

2007

First investment in Lithuania

Novaturas2008

EI raises Enterprise Venture Fund I with total capital of EUR 100 million

2009

EI opens an office in Prague

2010

First investment in Hungary

Netrisk.hu2010

First investment in Estonia

Nortal2012

First IPO on the NYSE of a company from EI’s portfolio

AVG Technologies2012

EI raises Polish Enterprise Fund VII with capital of EUR 314 million

2015

First IPO on the Prague Stock Exchange of a company from EI’s portfolio

Kofola ČeskoSlovensko2016

First investment in Slovenia

Intersport ISI2017

EI raises Polish Enterprise Fund VIII with total capital of EUR 498 million

2018

Thirty-fifth IPO from EI’s portfolio and the first on Nasdaq Vilnius

Novaturas2018

First investment in Croatia

PAN-PEK

EI opens a Zagreb office covering the entire Adria region

2021

First public-to-private transaction

PragmaGO2023

EI raises Enterprise Investors Fund IX